OURGROUP

The General Capital Group consists of General Capital, General Finance, and Investment Research Group (IRG), each serving a unique role. General Finance focuses on deposit taking and mortgage lending, while IRG provides investment research and corporate finance services. Together, they offer a suite of financial solutions, combining lending, investment, and advisory expertise to drive growth.

General Capital Limited is a financial services group listed on the NZX Main Board (NZSX), trading under the code GEN:NZ.

Shares can be bought and sold through any NZX participant, as well as a wide range of Investment Advisers in New Zealand. International investors may also trade General Capital shares through global stockbrokers and advisers who have established relationships with New Zealand associates.

General Finance is a New Zealand-owned and operated finance company, functioning as a wholly owned subsidiary of General Capital Limited. As a licensed Non-bank Deposit Taker (NBDT), General Finance accepts deposits from the public and provides loans secured over residential and commercial properties.

Investment Research Group (IRG) is a wholly owned subsidiary of General Capital Limited. IRG operates as a research house and investment banking firm, offering services such as investment advisory, corporate finance. As an NZX sponsor, IRG facilitates company listings on the New Zealand Stock Exchange, providing expertise in navigating the listing process.

BOARD OFDIRECTORS

At General Finance, our Board of Directors brings together a wealth of experience in finance, investment, and strategic growth. With a deep understanding of markets and a commitment to delivering sustainable value, they guide our vision and ensure we remain at the forefront of financial innovation.

Each member brings unique expertise, but together, they share a common goal: to empower businesses and investors with smart, forward-thinking financial solutions. Meet the leaders who shape our journey.

FINANCIALREPORTS

Full financial information is available in our most recent annual accounts.

The accounts for the last three years are available here:

CREDITRATING

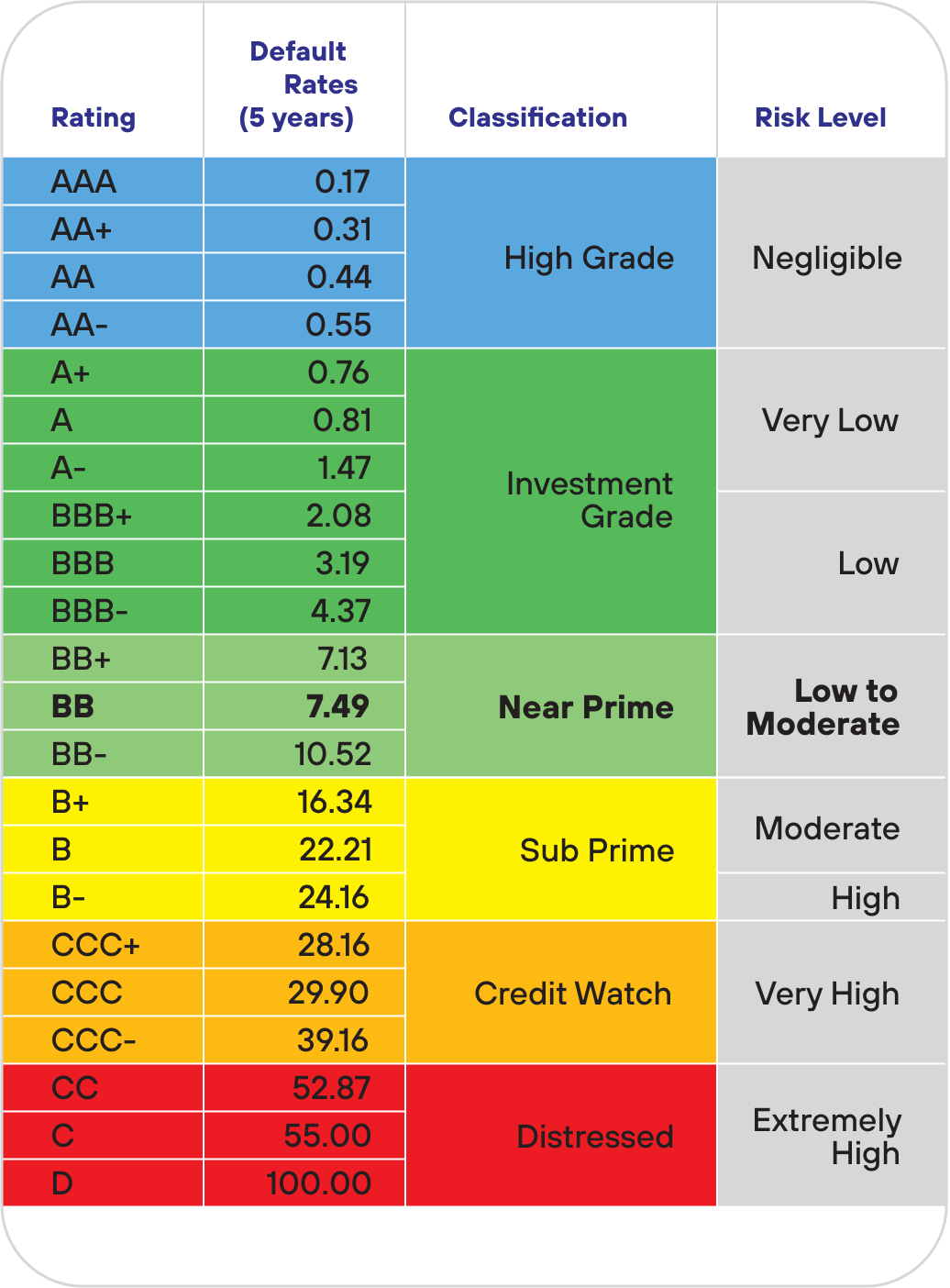

A credit rating is an independent opinion of the capability and willingness of an entity to repay its debts (in other words, its creditworthiness). It is not a guarantee that the financial product being offered is a safe investment. A credit rating should be considered alongside all other relevant information when making an investment decision.

General Finance has been rated by Equifax Australasia Credit Ratings Pty Ltd (“Equifax”). Equifax gives ratings from AAA through to C (excluding ratings attaching to entities in default).

On 10 December 2025, Equifax reaffirmed the credit rating of General Finance Limited as BB with a Positive Outlook. According to Equifax’s criteria, this rating is classified as “Near Prime” and has “Low to Moderate” risk level.

A copy of the credit rating report is available by clicking the link.

Also available at https://www.business.govt.nz/disclose, by searching the Register for offers by General Finance Limited.

DEPOSITORCOMPENSATIONSCHEME

Protecting your deposits – Peace of mind with General Finance

The New Zealand Government is introducing the Depositor Compensation Scheme (DCS) to provide eligible depositors with added confidence and security. This scheme is designed to protect up to $100,000 per eligible depositor, per licensed institution in the unlikely event of a failure.

The Depositor Compensation Scheme covers you up to $100,000 if your deposit taker fails, when your money is held in DCS-protected accounts.

What is the Depositor Compensation Scheme?

The DCS is a government-backed initiative to protect retail depositors by guaranteeing their deposits up to $100,000. Administered by the Reserve Bank of New Zealand, this scheme ensures that New Zealanders have greater financial protection when placing funds with licensed deposit takers.

How does it work?

- Covers up to $100,000 per depositor, per institution

- Applies to eligible products, such as term deposits, transaction accounts, saving accounts and notice accounts

- Compensation is paid by Government controlled entity

- Funded by levies on licensed deposit takers

What products are covered?

Under the Scheme, General Finance term deposits will be covered.

Who is eligible?

Anyone who holds money in term deposits with General Finance will be covered by the Scheme. In the event of the failure of General Finance, your term deposits will be protected by up to $100,000 by the Scheme.

General Finance’s commitment

We support the Government’s initiative to enhance financial stability and provide better protection for depositors. Our clients’ trust and peace of mind are our top priorities.

Learn more

To read more about the scheme, visit the Reserve Bank of New Zealand website or download the RBNZ DCS explainer brochure

If you have any questions, feel free to contact our team at investment@generalfinance.co.nz or call us at 0800 500 602.

PRODUCTDISCLOSURESTATEMENT

The Product Disclosure Statement for General Finance Limited has been lodged with the Register of Financial Service Providers.

The offer of Term Deposits by General Finance Limited is open for applications, from 3 February 2016.

Also available

https://www.business.govt.nz/disclose, by searching the Register for offers by General Finance Limited.

The Product Disclosure Statement refers to additional information being available on the Register at https://www.business.govt.nz/disclose. This additional information is available in documents on the Register called Key ratios and selected financial information and Ranking of debt securities

Alternatively, you can download the recent information here:

FAIR CONDUCT PROGRAMME

General Finance is a financial institution subject to the financial markets (conduct of institutions) amendment act 2022 and is required to have a Fair Conduct Programme.

The summary aims to help consumers to :

- Be aware of how general finance will comply with the fair conduct principle, and

- Make informed decisions when dealing with general finance in relation to the products and services we provide; and

- Understand how to raise a complaint about our products and services when General Finance fails to treat consumers fairly.

CompanyDirectory

General Finance

Issuer and Promoter

General Finance Limited

PO Box 1314, Shortland Street, Auckland 1140

Freephone: 0800 500 602

Telephone: (+64)9 526 5000

Email: investment@generalfinance.co.nz

Website: www.generalfinance.co.nz

Registered Office

Level 8, General Capital House, 115 Queen Street, Auckland, New Zealand

Banking Partners

Bank of New Zealand Limited

Westpac Banking Corporation

Heartland Bank

Securities Registrar

Computershare Investor Services Limited

Private Bag 92119, Auckland Mail Centre, Auckland, 1142

Level 2,159 Hurstmere Road, Takapuna, Auckland, 0622

Telephone: 09 488 8777

Facsimile: 09 488 8787

Auditors

Grant Thornton New Zealand

152 Fanshawe Street, Auckland CBD, Auckland 1010

Phone: 09 308 2570

Trustee

Covenant Trustee Services Limited

PO Box 4243

Shortland Street

Auckland, 1010

Telephone: 09 302 0638

Companies Office

Registrar of Companies

Private Bag 92061, Auckland Mail Centre, 1142

Freephone : Ministry of Economic Development Business Service Centre 0508 266 726

Facsimile : 09 912 7787

Website : www.business.govt.nz/companies/